Stock Markets in under 15 minutes. No ads. No politics. Easy to follow for your morning coffee, dog walk or commute.

Paid Episode 39 min

Free Episode 26 min

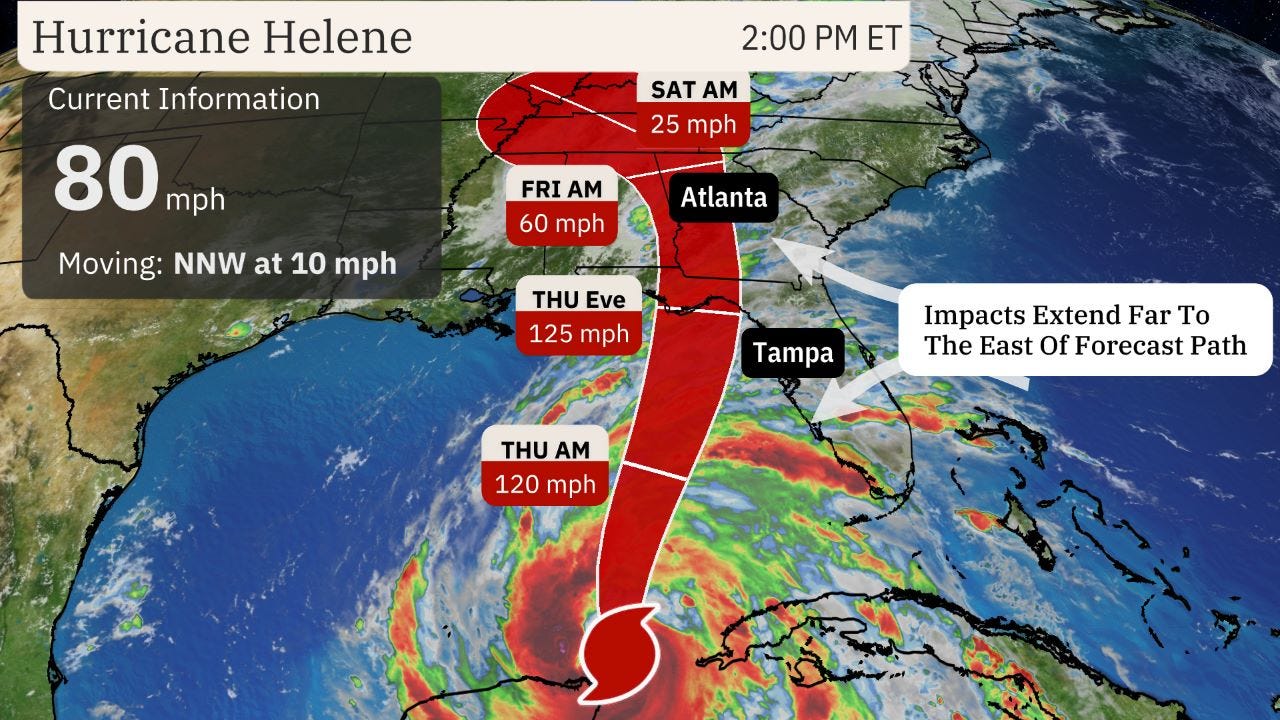

To everyone in Hurricane Helene’s path in Florida and Gulf, good luck and be safe.

Hurricane Helene is threatening the entire coast of Florida with up to 120 mph winds and 15 feet of surge.

On Tuesday $NVDA accounted for 93% of the gains in the Bloomberg 500, which is a proxy for the S&P 500. NOT healthy!!!

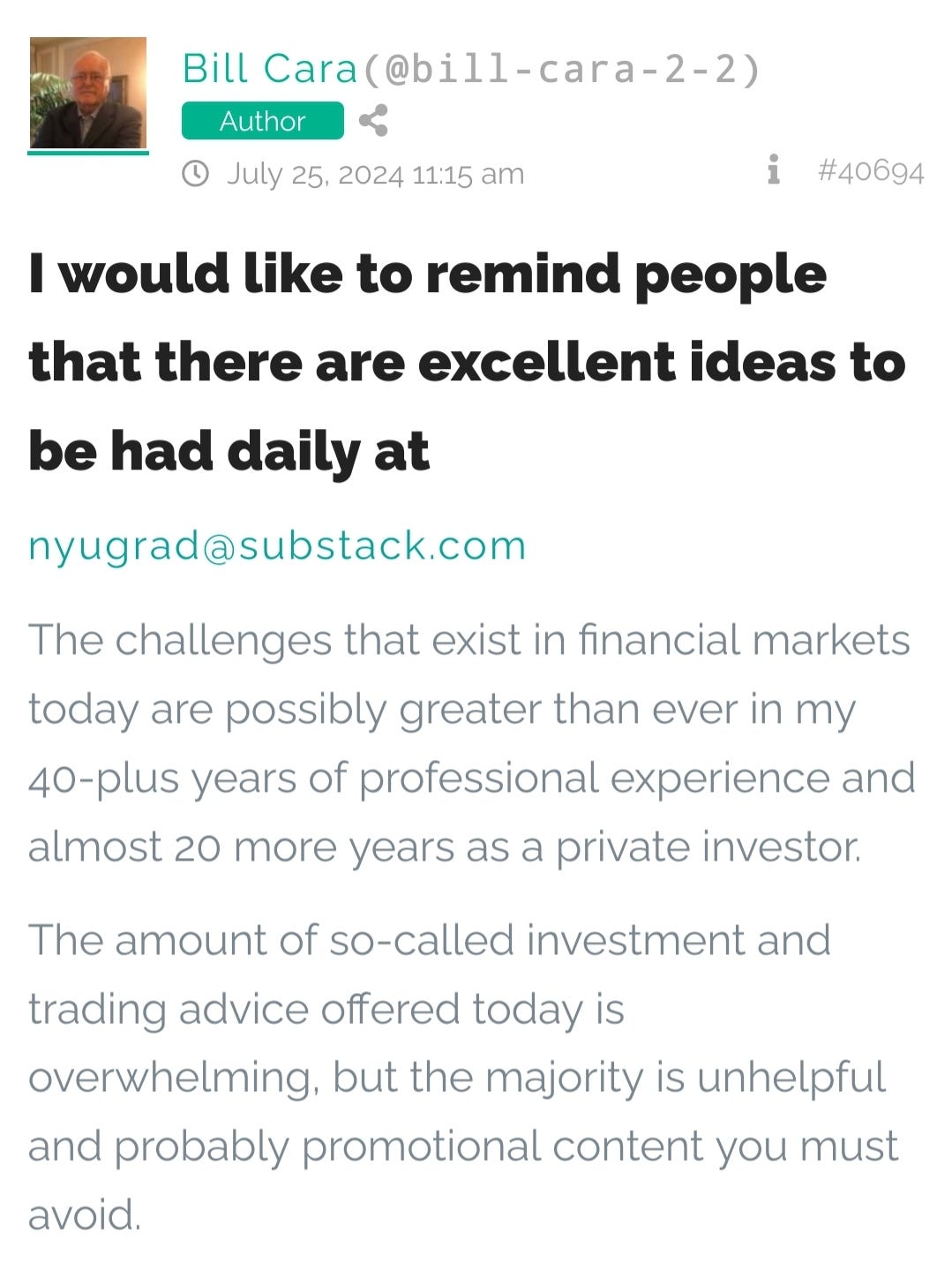

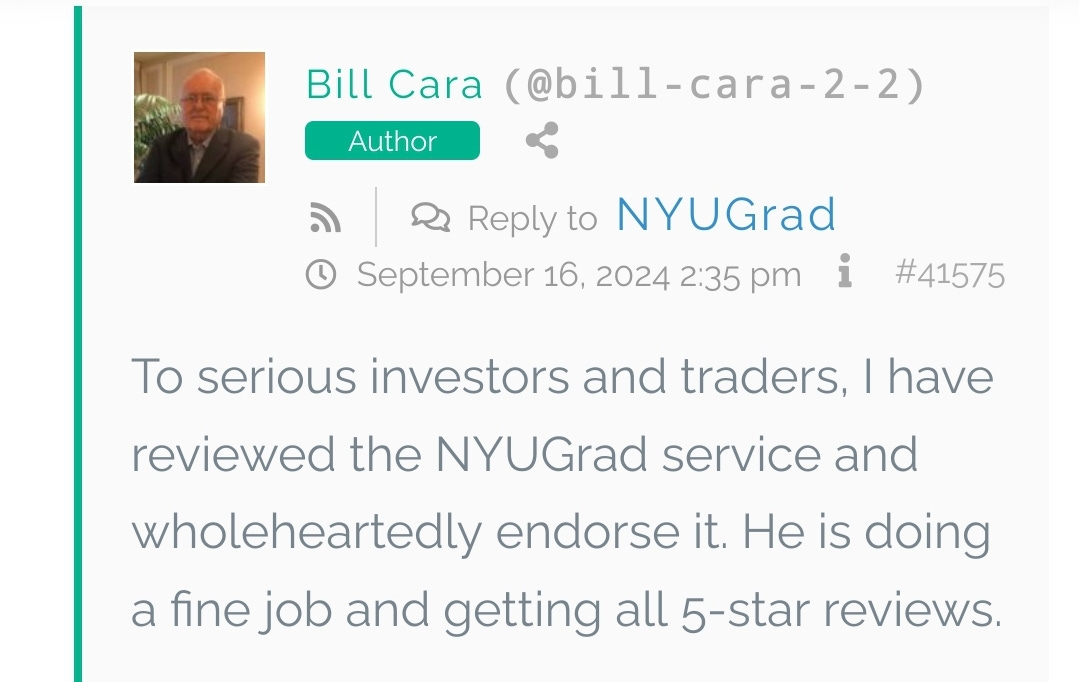

From a man that has been trading professionally longer than I have been alive…

“Warren Buffett’s $300 Billion Cash Bet: Preparing for a Global Financial Reckoning”

As of August 15th, Warren Buffett’s Berkshire Hathaway held a staggering 42.75% of its total market and private investments value in cash—amounting to nearly $300 billion. This growing cash pile strongly suggests Buffett is bracing for a major market downturn. Investors should note what he’s selling, such as Apple and Bank of America shares, as these may be the holdings he considers most vulnerable in an upcoming crash.

Buffett is well aware of the mounting global financial risks, particularly the unsustainable government debt levels. Across the world, deficit spending continues unchecked, regardless of the political party in power. The total debt and accruing interest on this debt is now a ticking time bomb that today’s economic engines are ill-equipped to defuse.

Central banks have recently begun slashing interest rates in response to deteriorating financial conditions. A few weeks ago, several countries cut their policy rates, and the price of gold surged. When the Federal Reserve followed with a 50-basis point rate cut, it further fueled gold’s upward trajectory. This precious metal, being debt-free, stands out as a reliable store of value during times of crisis. Gold is poised to soar even higher as more central banks lower their rates.

I’ve also warned about the dangers of Wall Street’s recent wave of IPOs, secondary offerings, and share buybacks. The banking cartel—what I call Humongous Bank & Broker (HB&B)—is draining wealth from hard-working people to pad the pockets of financial engineers. Much like in 2007, the era of credit expansion is coming to an end. Deflation is now the real concern.

Back then, I warned, “Books will be written!” I am saying that again today.

Adding to the current crisis is the fact that COVID-19 has devastated commercial real estate. People avoided office spaces, leading to massive losses for banks and their investor friends who had made risky investments in this sector. As the Fed continues to cut rates later this year and next to prop up these failing assets, it’s clear that the central bank is working to save the banking cartel, not the public. Investors have been misled for years into believing that rate cuts are a green light to buy stocks. The opposite is true.

At the very least, we should shift from financial assets to hard money like precious metals. Physical Gold, in particular, remains free of debt and is outside the grasp of HB&B’s financial manipulation through futures and ETFs. It will endure, as will the miners who produce it.

I made a similar call in 2006, when I warned my readers about the real estate bubble. I pointed to CNBC’s nationwide real estate tour as a sign that the banking cartel was pulling its investments ahead of the crash. My prediction earned me a feature in The Wall Street Journal’s new “Competing Viewpoints” series. The WSJ editors told me they couldn’t find any financially respected Americans willing to make the same call. I did.

For those who doubt my certainty about the end of the equity bull market that began in 2009, look no further than China. This week, the People’s Bank of China cut its reserve requirement for banks and offered mortgage relief. Its 10-year bond yield hit a historic low of 2%, and the PBOC is about to inject 500 billion yuan (around $71 billion USD) into the stock market. These extreme measures signal the looming deflationary crisis.

Now is the time to follow Buffett’s lead. He’s selling equities to build cash reserves, preparing to buy strong companies post-crash. The public should consider doing the same, particularly by increasing their exposure to precious metals—an asset class held in high esteem for millennia. Central banks in China and India are buying gold in vast quantities, and soon, it will be on everyone’s radar as the global economy shifts into a new phase.

Wrapping up:

Warren Buffett does not hold almost $300 billion in cash for no reason. As governments face insurmountable debt and deflation looms, gold and other hard assets will become central banks’ and everyday investors’ go-to safe-havens. Follow the signs, prepare for the downturn, and remember that sometimes, the best investment is the one you don’t make—until after the storm “

-Bill Cara

A main safety stock I recommended hitting all time highs. Up 33% since I sent alert 🤟

$APP. Applovin is up over 280% since I alerted my premium subscribers in Feb 2024, only 8 months ago!

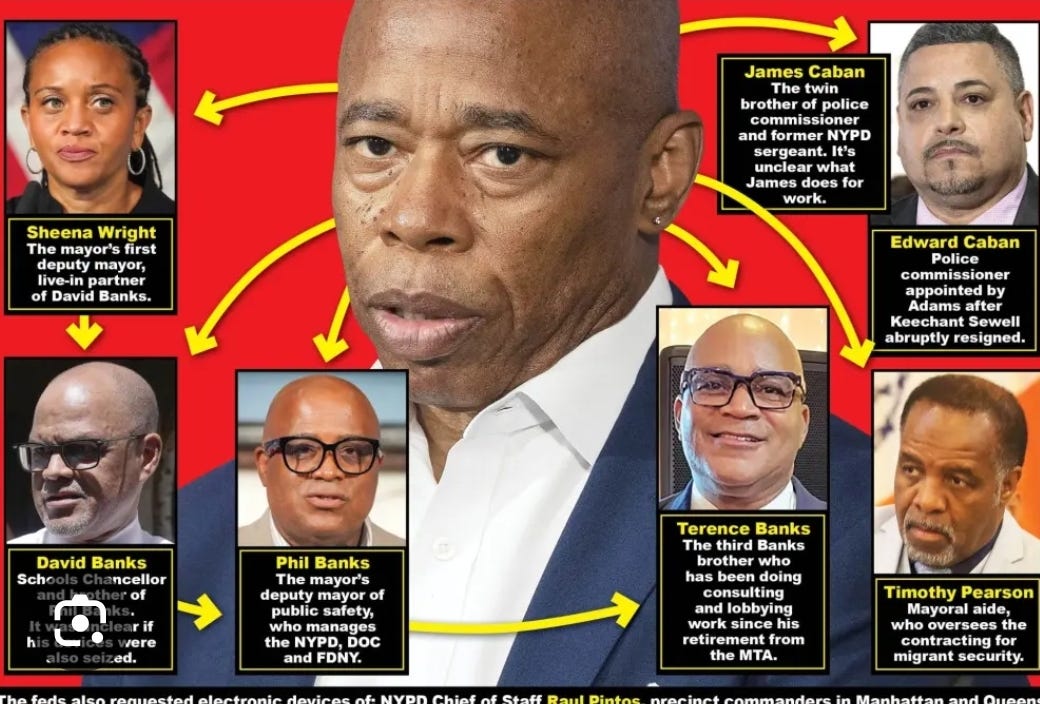

Speaking of cartels

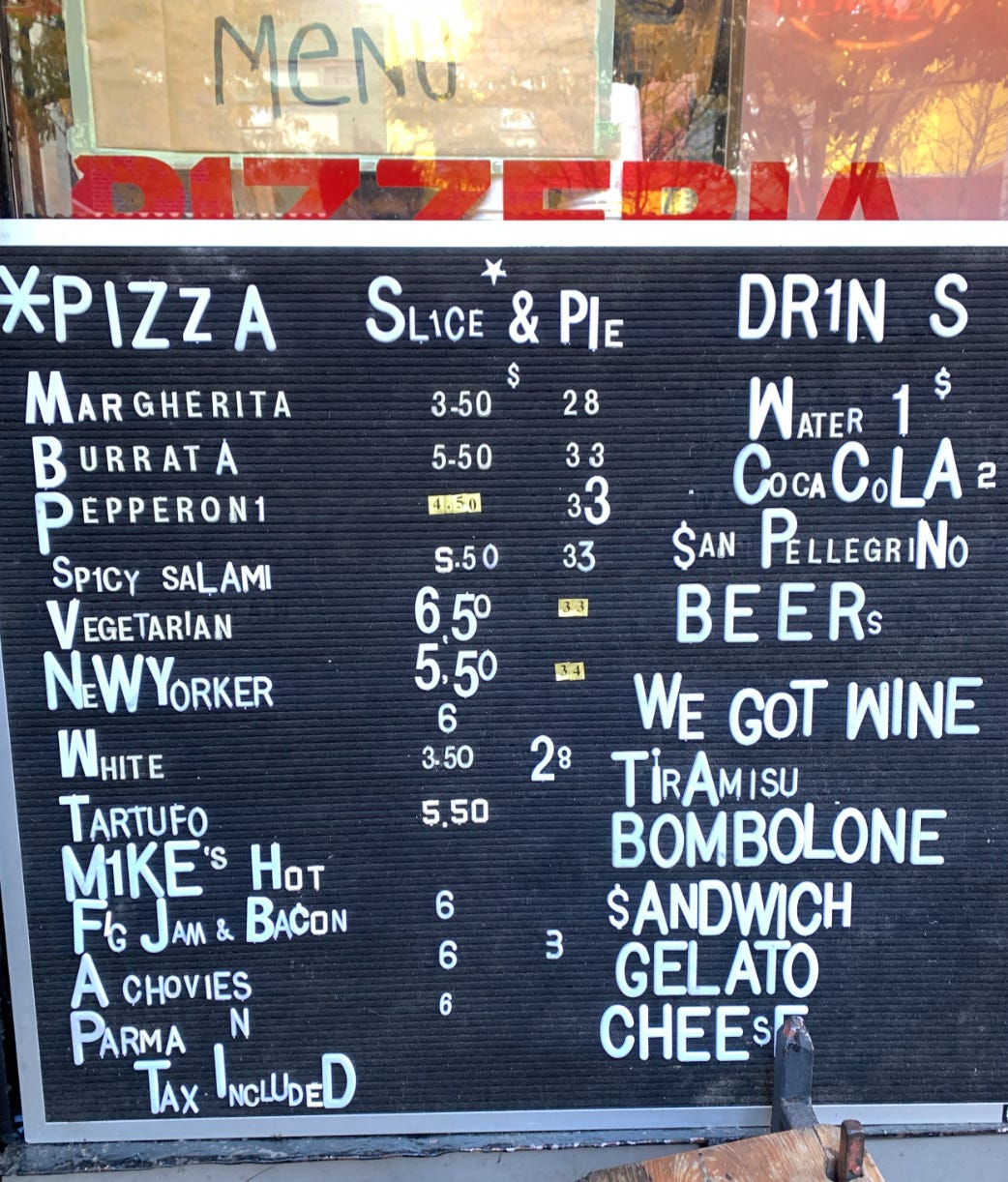

Upgrading to paid content is an investment of $34 per month. The price of a NY Pizza Pie at L'industrie.

Whether you subscribe for free or paid, you will gain value and ability over time to see stock market price movement in a way Wall St does not want you to see.

At the very least, improve your own education so you can grade your financial advisors homework and performance!

What will premium include? (at minimum)

Over time you will gain the ability to see stock market price movement in a way that Wall St does not want you to see

Be more comfortable managing your own wealth

Learn so you can at the very least grade your financial advisor’s work

Actionable Watchlist(s) and charts

Premium only content

Daily - Unlocked full podcast episodes & full show notes

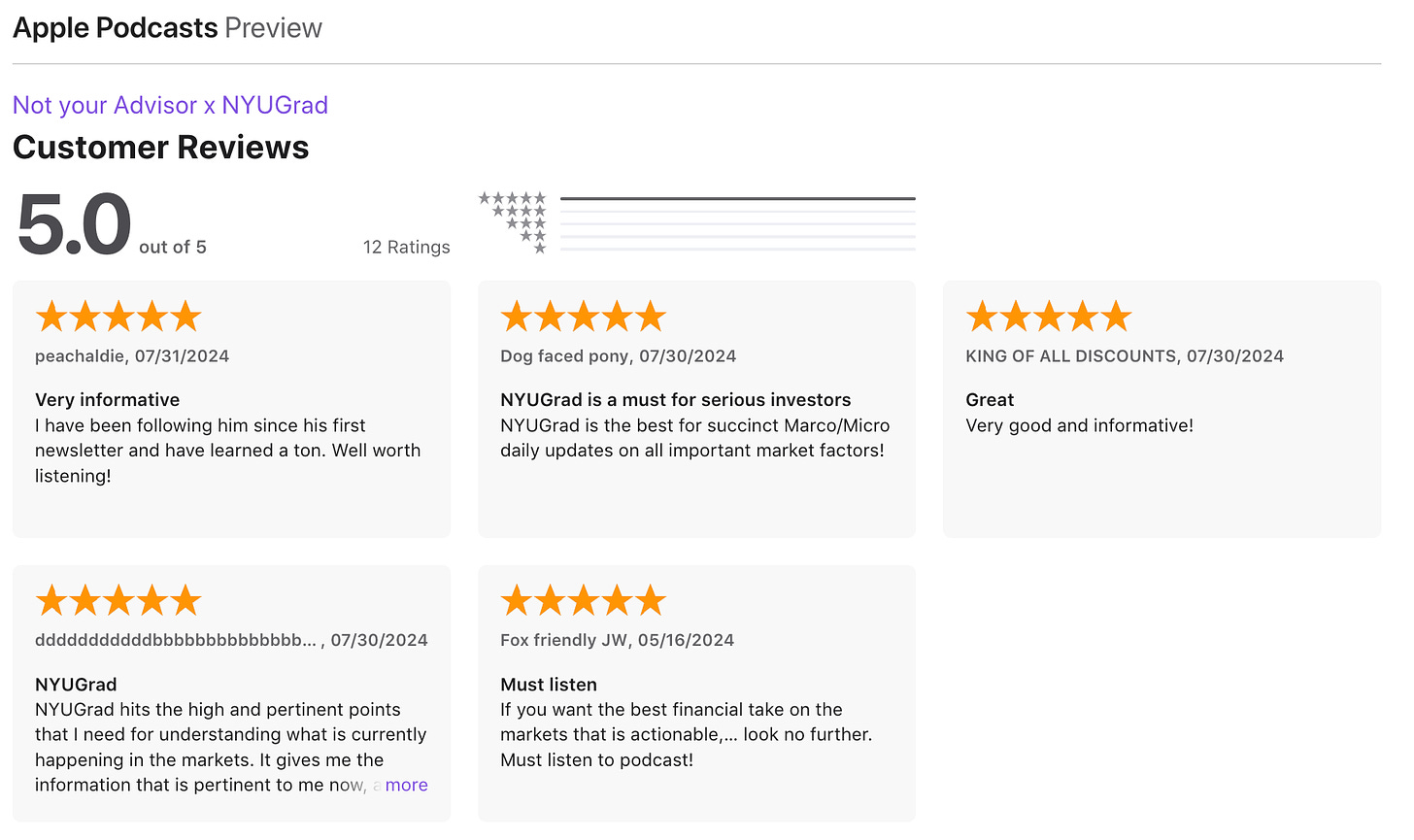

Reviews from paying subscribers and professionals

One Paying Subscriber Example:

“Thanks for consistent, quality content. It’s educational and has paid for itself several times over.

Even though I don’t actively trade, there’s so much usefulness in the daily podcast for navigating the bigger picture for my 401(k) and IRA. Often you touch on factors that will impact my clients at my day job, so it’s useful there too.

Finally, and perhaps most importantly, there’s a “Zen and the art of” quality to your world. it’s educational, elucidating, and exists at the intersection of theory and practice. Thoughtful and worthwhile!" - Will (Paying Subscriber)

Bill Cara, 40+ Year Market Professional and Author

Podcast Listeners

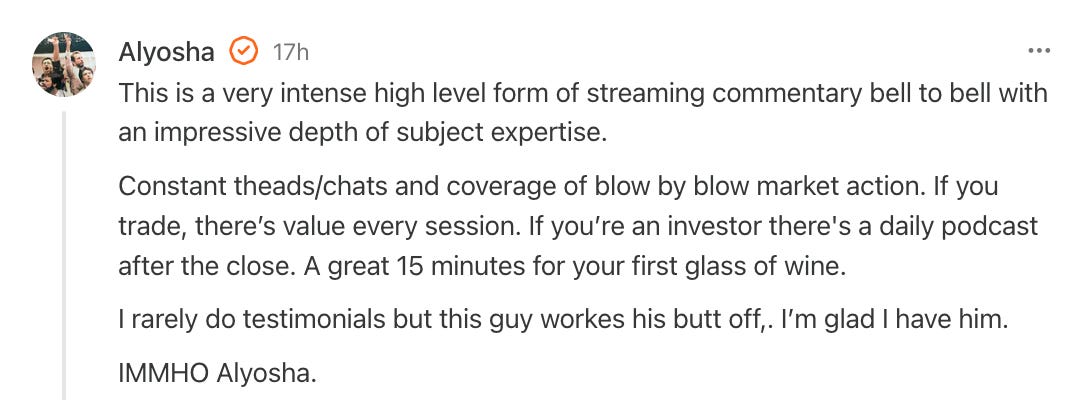

Alyosha is a professional Comex trader and writes market vibes

Financial Freedom is not free, but the treasure is worth the pursuit!

Follow me on Substack Notes

Podcast Available on Spotify | Apple | Amazon

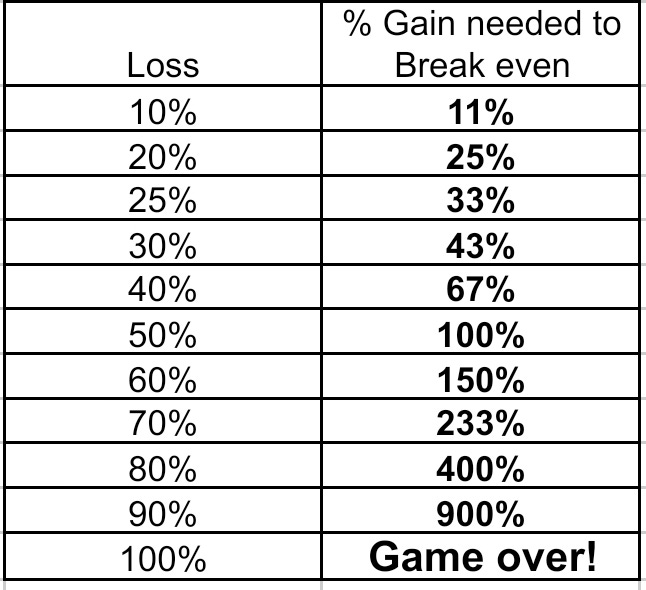

Save this spreadsheet or memorize it

What to watch

Watch mag 7

Watch yields

Credit card delinquency rate (1991-Present)

True Rate of Unemployment (24%!!!)

Using data compiled by the federal government’s Bureau of Labor Statistics, the True Rate of Unemployment tracks the percentage of the U.S. labor force that does not have a full-time job (35+ hours a week) but wants one, has no job, or does not earn a living wage, conservatively pegged at $25,000 annually before taxes.